Import into Switzerland

Entering the Swiss jurisdiction

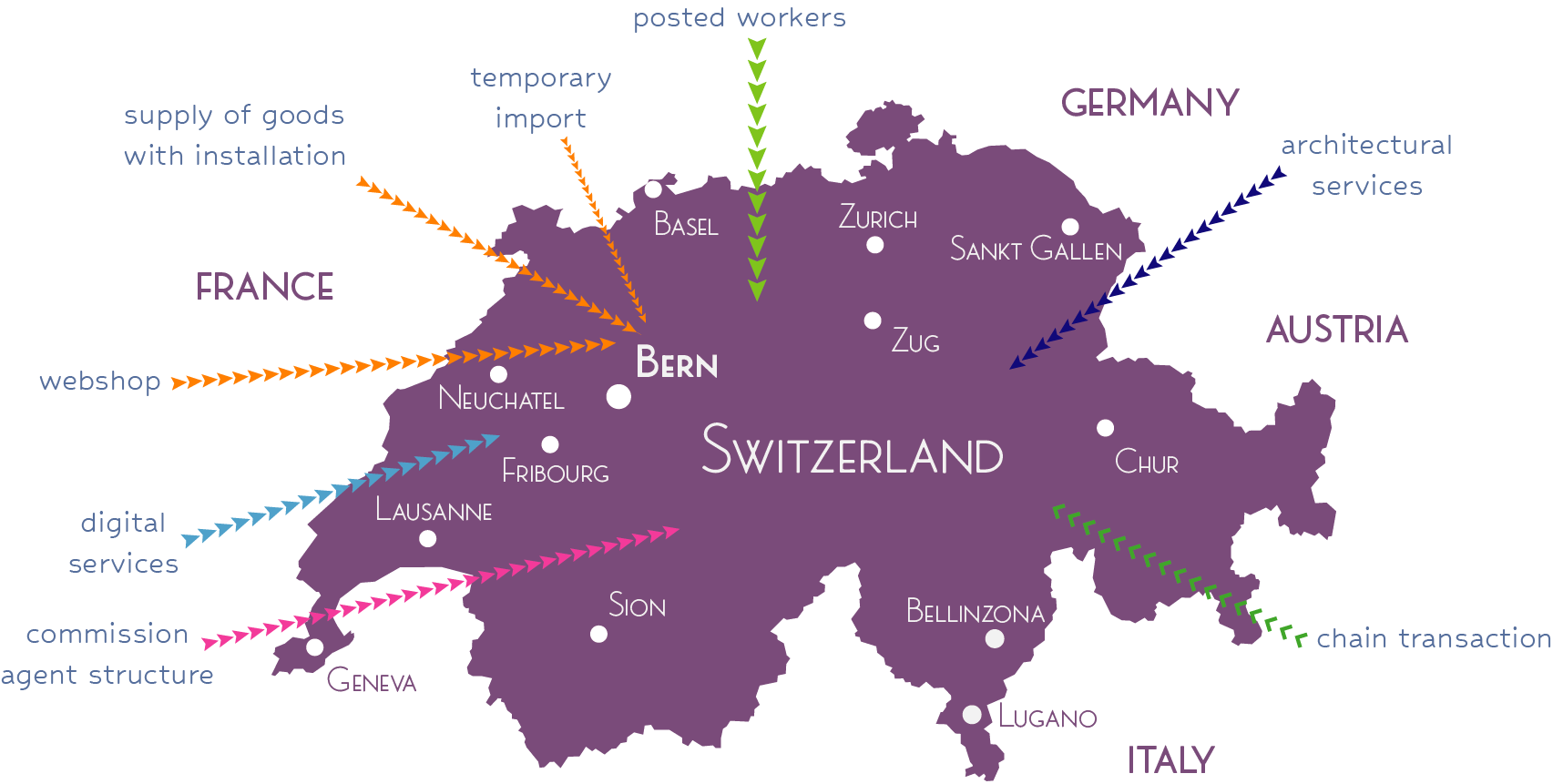

Companies that export goods for purposes of import in Switzerland (and/or Liechtenstein*) should have a clear picture of how the border formalities are handled, what conditions must be met for having goods released for free circulation, as well as what consequences are connected with goods coming from abroad entering the Swiss jurisdiction.

* Switzerland and Liechtenstein form one customs territory respectively one VAT territory. The Swiss customs authorities handle the import formalities for imports into Liechtenstein. Foreign companies that are registered for purposes of Swiss VAT will report their transactions with customers (turnover) in or suppliers (input VAT) from Liechtenstein in their Swiss VAT return.

Customs

The person obliged to make the customs declaration is, the person obliged to present the goods, the person commissioned with submission of the customs declaration, or the person who changed the intended use of the goods.

Any person who brings goods into the customs territory, has them brought into the customs territory or subsequently takes them over is obliged to present the goods to the customs office. Persons liable to present the goods to the customs office are in particular the carrier of the goods, the person responsible for presenting the goods, the importer, the consignee, the consignor and the principal. The principal is deemed to be any person who actually initiates the importation of goods.

The person required to declare must declare the goods brought to the customs office, presented and summarily declared for assessment within the period specified by the customs administration and submit the accompanying documents. The person required to declare must immediately bring the goods to the nearest customs office unchanged.

The customs assessment procedure is governed by the self-declaration principle. The declarant bears full responsibility for a complete and correct customs declaration.

Generally, the customs debt is incurred at the time when the customs office accepts the customs declaration.

If the customs declaration was omitted, the customs debt shall be incurred at the time when the goods are brought across the customs border or are used for another purpose or are handed over or are handed over outside the free period, or, if neither of these times can be determined, at the time when the omission is discovered.

Basis for the assessment is the customs declaration. The customs declaration may be corrected by the customs office. Goods that have not been declared shall be assessed ex officio. The debtors are jointly and severally liable for the customs debt. Recourse among them is regulated by civil law / contract law.

The amount of customs duty is calculated according to the type, quantity and nature of the goods at the time they are declared to the customs office and according to the customs duties and assessment bases applicable at the time the customs debt is incurred.

Taxes

The person obliged to make the customs declaration is, the person obliged to present the goods, the person commissioned with submission of the customs declaration and persons who change the intended use of the goods.

Any person who brings goods into the customs territory, has them brought into the customs territory or subsequently takes them over is obliged to present the goods to the customs. Persons liable to present the goods to the customs are in particular the carrier of the goods, the person responsible for presenting the goods, the importer, the consignee, the consignor and the principal. The principal is deemed to be any person who actually initiates the importation of goods.

The person required to declare must declare the goods brought to the customs office, presented and summarily declared for assessment within the period specified by the customs administration and submit the accompanying documents. The person required to declare must immediately bring the goods to the nearest customs office unchanged.

The customs assessment procedure is governed by the self-declaration principle. The declarant bears full responsibility for a complete and correct customs declaration.

Generally, the customs debt is incurred at the time when the customs office accepts the customs declaration.

If the customs declaration was omitted, the customs debt shall be incurred at the time when the goods are brought across the customs border or are used for another purpose or are handed over or are handed over outside the free period, or, if neither of these times can be determined, at the time when the omission is discovered.

Basis for the assessment is the customs declaration. The customs declaration may be corrected by the customs office. Goods that have not been declared shall be assessed ex officio. The debtors are jointly and severally liable for the customs debt. Recourse among them is regulated by civil law / contract law.

The amount of customs duty is calculated according to the type, quantity and nature of the goods at the time they are declared to the customs office and according to the customs duties and assessment bases applicable at the time the customs debt is incurred.

Other laws affecting trade

The person obliged to make the customs declaration is, the person obliged to present the goods, the person commissioned with submission of the customs declaration and persons who change the intended use of the goods.

Any person who brings goods into the customs territory, has them brought into the customs territory or subsequently takes them over is obliged to present the goods to the customs. Persons liable to present the goods to the customs are in particular the carrier of the goods, the person responsible for presenting the goods, the importer, the consignee, the consignor and the principal. The principal is deemed to be any person who actually initiates the importation of goods.

The person required to declare must declare the goods brought to the customs office, presented and summarily declared for assessment within the period specified by the customs administration and submit the accompanying documents. The person required to declare must immediately bring the goods to the nearest customs office unchanged.

The customs assessment procedure is governed by the self-declaration principle. The declarant bears full responsibility for a complete and correct customs declaration.

Generally, the customs debt is incurred at the time when the customs office accepts the customs declaration.

If the customs declaration was omitted, the customs debt shall be incurred at the time when the goods are brought across the customs border or are used for another purpose or are handed over or are handed over outside the free period, or, if neither of these times can be determined, at the time when the omission is discovered.

Basis for the assessment is the customs declaration. The customs declaration may be corrected by the customs office. Goods that have not been declared shall be assessed ex officio. The debtors are jointly and severally liable for the customs debt. Recourse among them is regulated by civil law / contract law.

The amount of customs duty is calculated according to the type, quantity and nature of the goods at the time they are declared to the customs office and according to the customs duties and assessment bases applicable at the time the customs debt is incurred.

Prevent unfounded assumptions

Experience shows that often foreign companies, or their Swiss contract partners, make assumptions about the application of provisions relating to customs, VAT or other import relevant regulations.

Wishful thinking often concerns the status of Switzerland and the impact thereof on cross-border transactions, when the distinction between B2B and B2C transactions matters, the relevance of incoterms, the person that given the character of the transaction must act as importer, the way how Swiss import formalities are actually executed, or the usual requirements applied by Swiss customs forwarders.

The person required to declare must declare the goods brought to the customs office, presented and summarily declared for assessment within the period specified by the customs administration and submit the accompanying documents. The person required to declare must immediately bring the goods to the nearest customs office unchanged.

Mind over matter

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis.

Do you have what it takes to qualify as importer?

The character of the transaction in which scope the import takes place may determine who will have to act as importer.

Regardless the applied incoterms, generally the consignee will be the deemed importer. In case of supply of goods with installation by / for account of the supplier, the latter will have to act as importer. Suppliers with a so-called "Unterstellungserklärung Ausland" will be considered the importer -unless they apply the exception for the specific transaction.

What qualifies as import of goods?

Every time goods coming from abroad are passing the customs border the event "import" takes place and thus the set of rules that regulate importation become applicable.

Depending the character of the imported good, underlying cause giving rise to import, mode of import, for each of the following examples an import will trigger its own relevant procedure: delivery of goods to a customer in Switzerland, inbound transfer of own goods, rental goods that pass the border on their way to the rentee, temporary import of equipment / tools / machinery, data carriers with software brought accross the border, air planes -regardless for commercial civil aviation or not- landing on Swiss territory, inbound transfer of electricity or liquid substances through pipelines.

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit.

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit.

Are your goods allowed to be imported?

Swiss import regulations or local requirements may differ from the country of export or the home country of the supplier.

In order to prevent fines, destruction under customs supervision, delays and high unforeseen costs, a complying supplier verifies in advance what regulations or restrictions apply respectively whether they have changed since the last export or verification.

What are the legal consequences of importing?

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit.

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit.

Pre-control / concurrent control / post control?

Foreign companies that either as supplier or buyer are involved in Swiss import transactions should in advance think whether and how they want to control the process of import formalities and compliance.

Frequency, volume or value of the individual or total of import transactions, customer relationship, company reputation, resilence capacity and ~policy are parameters that a company will take into account when considering, designing and implementing the strategy and tools for supervision of the business / logistic / customs / tax processes in connection with import.